Voltage stabilizers intrigue me. In India, and especially in rural or small-town India, these relatively expensive devices have been indispensible for years now. If you operate a refrigerator, a computer, a stereo system or other such electronic gadget, a stabilizer is like an insurance policy against damage. You'd be a fool not to use one.

So, given the huge market for knick-knacks you would want to protect with stabilizers, making them is a profitable enterprise. In fact, it's safe to say that the stabilizer business makes a steady contribution to the health of our economy.

Spare a thought, though, for why we need stabilizers in the first place: because of wild voltage fluctuations in the electricity that's supplied to us. Those happen because of inefficiencies in the generation and transmission of electricity. We are so used to these fluctuations now that we don't even think they are abnormal: we just buy stabilizers and put them to use like any other consumer product. In fact, they are just another consumer product.

We probably also don't think, as we buy stabilizers, that we are pumping up the GDP of the country, which we are. But if we did think of it, we might find a small perversity here. Since we tolerate inefficiency in one part of our economy -- the generation of electricity -- we need devices whose production and purchase shore up another part of our economy. A simplistic view? But this is essentially what is happening. A whole industry, for a wholly unnecessary product, has grown out of inefficiency. What's more, if our electricity supply ever becomes stable and reliable -- an aim certainly worth striving for -- that whole industry will become redundant.

Put another way, inefficiencies which actually cause severe losses lead to a boost in the GDP. If we correct those inefficiencies, we could end up damaging specific sectors in the economy. Look at your voltage stabilizer in that perverse light.

Now every political party is infatuated with the GDP. Asking for votes, they all promise "rapid" or "double-digit" yearly increases in the GDP, as if that is an unquestionably desirable thing. But such infatuation leaves unanswered this question: how is it that tolerating inefficiency is considered a positive influence on our economy?

The problem lurking here is the use of the GDP as an indicator of economic health. The Gross Domestic Product is just a measure of market activity: money changing hands. Every transaction of money adds to the GDP. With barely a question, this has become the indicator of the health of a nation. The greater the GDP, and especially the faster it grows, the better a country is said to be doing. No wonder our parties promise to raise it.

But think: should we not account for the kind of transactions made? Should there not be some totting up of the costs to the country of certain sorts of market activities?

Take the use of stabilizers, again. Let's say you buy a computer. Doing so, you add to the GDP. Some weeks later, the unstable electricity supply fries your shiny new Pentium (which once happened to me). You either repair it or buy a new one. Whichever, you add to the GDP. This time, you are a little more clever: you buy yourself a stabilizer as well. With that purchase, you add to the GDP again.

Instead of just one purchase, you have made at least three, all of which fed the greedy maw of GDP. You have contributed, three times over, to making India's economy a booming, vibrant one. Why, you may wonder, are you also three times as annoyed?

But the rapid development of Tirupur has meant that its water sources are either hopelessly polluted by its factories or have dried up altogether, unable to keep up with the demand. For some years, Tirupur has trucked in water for its residents at a substantial cost. You guessed it: paying that cost adds to the GDP. Some day, someone will have to pay to clean up the pollution. You guessed it again: that transaction will also add to the GDP.

That is, Tirupur's pollution contributes to our GDP twice: once when its factories do the polluting, and once again when money must be spent to clean up. In some ways, Tirupur has robbed its future to pay for its present success. But even that theft is considered a gain for the economy.

The perverse nature of GDP is not just that it counts every transaction of money as a gain. It is also that it counts only transactions of money. It is also that it blithely ignores the environmental and social costs society will have to pay for depleting natural resources or ignoring social issues. Today, the more we use up India's natural resources, the more our GDP rises. There must be something wrong with a measure in which depleting your capital counts as current income, in which disaster is seen as gain.

But that's the GDP for you.

For so long has the GDP been so closely identified with a country's economic advance that people think of it as written in stone, a kind of standard. In reality, it is little more than a relic of an earlier era, when compulsions hardly relevant today drove its definition. The GDP is actually an avatar of the old Gross National Product, and both are strangely perverse measures. To understand why, consider the origins of the GNP.

In 1932, the US Commerce Department gave a young economist, Simon Kuznets, the task of devising a way to account for how well the economy was doing. It had no way to monitor the performance of the economy, a special hardship in those Depression years. It's not important here to spell out exactly what Kuznets came up with; enough to understand that he measured production and spending in the faltering economy of those years. Kuznets's work laid the foundation for what became the GNP and later the GDP.

Particularly during World War II, the GNP was the primary way the US kept track of its economy. As America pumped planes, tanks and guns out of its wartime factories, Kuznets' system helped locate and make use of unused production capabilities. This huge engine of production not only prepared a nation for war, it also brought it charging out from the Depression.

Significantly, this played a crucial, if little-known, role in winning the war. Lacking such an accounting system, Hitler had set himself far lower production targets. The US entry into the war meant that it would inexorably overwhelm German production and win the war.

This close identification of GNP with pure production, riding on victory in the war, set the course for economic policy for the next half-century. Because the war had been won, because US industrial output had been a major factor, and because the GNP measured that output, the craze for production became the peacetime model too. Production was a Good Thing. And while the military was the great wartime consumer, in peacetime it was ordinary citizens who consumed the products factories were churning out. Production was more than a Good Thing, it was Progress itself. Therefore the GNP, measuring production, measured progress too.

Nobody noticed at the time that Kuznets' system completely ignored social and environmental issues. In its single-minded devotion to industrial output, it also completely ignored other kinds of production.

This has had particularly harsh consequences for the developing world. Kuznets himself recognized the foolishness of the GNP when applied to poorer nations. There, significant production happens in the household economy, the voluntary sector -- all invisible to the GNP. If development aims to raise GNP, as it always has in these countries, it effectively marginalises the household economy. The results were clear in countries like India, Pakistan or Indonesia.

When the GNP mutated into the GDP in 1991, there was one subtle, insidious fallout. The earnings of a multinational company with plants in India, say, counted as part of the GNP of the country -- Germany, for example -- where it was owned. But under the rules of the GDP, they are counted towards the GDP of the country where the plants are located, even though the profits return to the MNC's home country. This peculiar little lie means that several desperate countries seem on paper to be booming. Meanwhile, richer countries walk away with resources of poorer ones, and this gets called a gain for the poor!

Many economists, aware of the shortcomings of the GDP, have put their minds to finding alternatives. But there is a block they must overcome, a simple principle they have lived with for years. In his famous text on Economics, Paul Samuelson puts it this way: "Economics focuses on concepts that can actually be measured."

That is, if something is hard to measure -- family life, open spaces, natural resources, pollution, the impact of fluctuating voltages -- it simply does not count in GDP calculations.

But just because we cannot always give a rupee value to some things, must we assume they have no value? (Think of this: Why does every new parent strive to spend time at home with her child? Surely not because such time spent has no value.) The challenge is to find a way to assign values to such things that are more real than zero, and take those values into account in a new measure of economic well-being. This would mean we start accounting for factors, positive and negative, which we all know are crucial to our national health, which each of us cares about every day, but which the GDP artfully sidesteps.

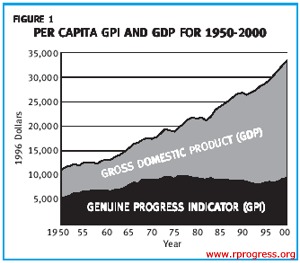

A research institute in California called Redefining Progress has proposed one such measure, called the "Genuine Progress Indicator" or GPI. The GPI starts with the same data the GDP is based on, but makes some changes. The result is not perfect, but it is a better balance sheet of the costs and benefits of growth.

Here, briefly, are just three of the factors the GPI accounts for.

There's crime. The GPI counts the money we spend deterring and punishing crime and repairing the damage it causes. So does the GDP, of course; but these sums, like others, inflate the GDP. The GPI acknowledges that this money is spent to reverse damage to society caused by crime; thus it accounts for these expenditures as losses, not gains.

There's the household economy. Taking care of our children, cleaning the house, cooking: tasks like these are vital to our well-being and that is why we do them every day. Yet if money does not change hands, the GDP does not account for them. The GPI does, valuing household work at the rate we would pay somebody to do it.

There's depletion of resources and the effects of pollution. As oil or minerals are used up, a country should treat this is as a cost, not a gain: just as families might if their bank accounts were diminishing. The GPI does just that. It also includes as costs the damage to our health and to agriculture from air and water pollution.

The GPI looks at more than twenty factors, like these three, that the GDP ignores. Put together, they form a far more realistic measure of how each of us views the state of our country, our lives, than the GDP does with its devotion to growth and production.

Applied to the American economy, the GPI is revealing indeed. While US per

capita GDP has about tripled since 1950, the GPI trend is startlingly

different. After increasing during the 1950s and 1960s, it declined to its

mid-60s level by 1995, before rising again: but it is still at less than a

third of per capita GDP. That may explain why so many Americans, through the

rosy pronouncements about progress during the Reagan and Clinton years, feel

more and more pessimistic about their lives. To that extent, the GPI is a

closer match than the GDP to the conditions people live in every day.

Applied to the American economy, the GPI is revealing indeed. While US per

capita GDP has about tripled since 1950, the GPI trend is startlingly

different. After increasing during the 1950s and 1960s, it declined to its

mid-60s level by 1995, before rising again: but it is still at less than a

third of per capita GDP. That may explain why so many Americans, through the

rosy pronouncements about progress during the Reagan and Clinton years, feel

more and more pessimistic about their lives. To that extent, the GPI is a

closer match than the GDP to the conditions people live in every day.

But as its authors at RP themselves point out, the GPI is not necessarily the answer. They write: "Measurement is a means, not an end." What's more important than measurement is to get those who speak easily of boosting the GDP to tell us exactly what they mean. And if they cannot see or will not address the costs of "progress", they are only as blind as the GDP has been for years.

And that should tell us something.